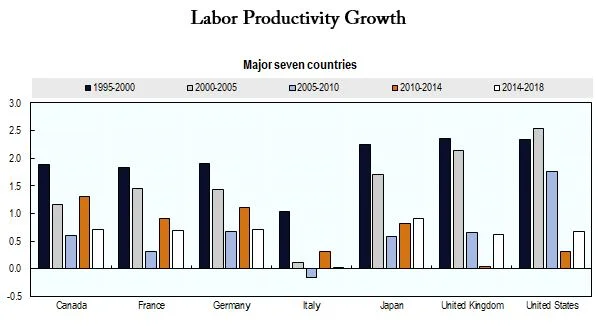

Labor and capital productivity across the world have become a point of concern and contention since the financial crisis. Trapped in an expansionary cycle with lower than average growth, many have pointed to low productivity growth as a leading factor. Government and monetary leaders have supplemented low productivity growth with massive credit growth (and Europe is already restarting its QE program!) Unfortunately increasing the availability of credit can only do so much to spur economic growth and innovation. When investors are too risk averse they have engage in less risky and consequently less innovative ventures. Companies are without a doubt innovating, but that takes time and risk and even further time for those innovations to impact the commercial space.

Read More