April 2019 - Research

Research: Q1 2019 Update

Q1 2019 is already on the books! March started off as a fairly quiet month for market activity until the last week of the month, when the dreaded yield curve finally resulted, see Chart I. The curve inverted Friday, March 22, with a -0.02 difference between the 10-Year and 3-Month Treasury. While an inverted yield curve correlates with a recession it does not cause a recession. The inversion is just one window into the market. How the markets and the economy will fare throughout 2019 is anyone’s guess. Three data points from the quarter are highlighted below.

3 Data Points from Q1 2019

~13%: S&P 500 YTD Return (through 3/22/19)

17: Consecutive weeks of Leveraged Loan Funds Outflow

Zero: Middle Market Loan Issuance (Feb, LevFin).

While the equity markets showed signs of optimism through Q1, such as rallying through the Fed’s decision to to hold rates steady at its March meeting, areas of the debt markets continue to show signs of cautious such as fund flows to loan funds.

We return to the Lipper Loan-Fund-Flows chart in March, which shows the trend in 2019 has not changed. The pace slowed in late-February and early-March but has regained momentum in mid-March. Retail investors have been the principal contributor to these outflows, likely attracted by the gains in the equity markets and desire to invest in more traditional and presumably safer asset classes.

The supply of new money and activity in the leveraged loan markets corresponds with the trends Lipper is showing. LevFin’s tracking of activity in the leveraged loan market shows a new trend,, fewer priced deals and fewer repayments.

The most poignant example of caution in the credit markets is the complete lack of activity in February 2019. Here’s the quote from LevFin insights, and corresponding chart (Chart IV).

“No market in middle market: After the relatively subdued months of December and January, activity in broadly syndicated middle-market financing flat-lined in February. It’s the first time LevFin Insights has observed a month with no middle-market new-issue activity since December 2016.”

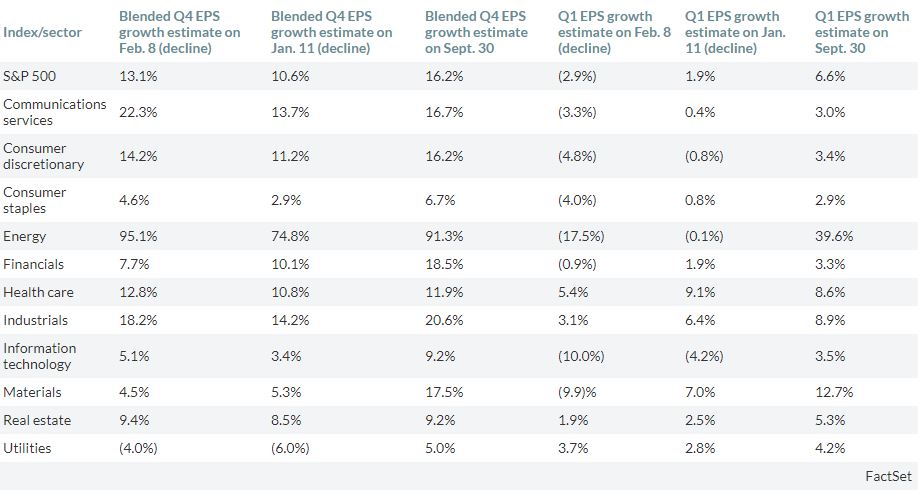

While the credit market is currently diverging from the equity markets, participants don’t necessary see this as the case for long. Analysts are estimating that Q1 2019 will show a decrease in earnings growth. Following last year’s tax cuts and the uncertainty surrounding international trade (U.S. - China negotiations, Brexit) large corporations are facing greater headwinds than in 2018.

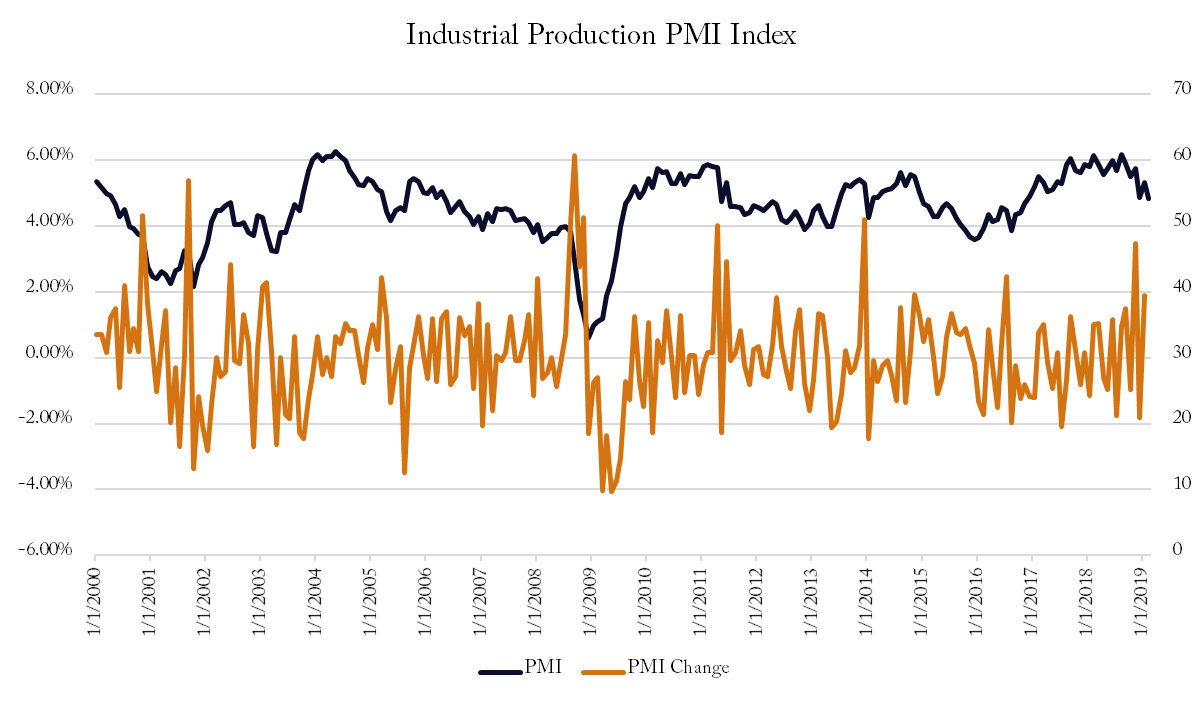

Economic activity is, in some areas, beginning to show signs of a slow down. While the Industrial Production PMI index hasn’t moved into contraction territory (a reading below 50), it is on a downward trend. “Total Business: Inventories to Sales Ratio” has continued to inch higher in that past 6 months. Rising inventory to sales levels suggest decreased

To conclude, while financial markets have been bullish to start 2019 the economic activity is suggesting there is less growth ahead. February showed a decrease in financial market activity and economic activity. We’re curious to see what the final Q1 GDP numbers come in at in the coming weeks and months. If one remembers Q1 2014 was the only negative growth quarter thus far in this expansion. This isn’t a prediction but a reminder that Q1 can show a divergence from trend.

Q1 2014 was also arguably a long enough time lag between the 2013 “taper tantrum”, which began in the early summer months of 2013, for economic results to feel the effect of a new monetary policy. Similarly today, after an extended period of rate hikes, the second order effects (changes in economic activity) might, now be finally coming to the surface. In the Fed’s desire to promote a freely functioning market it might have created too great of a dependence on its involvement in financial markets.