April 2020 - Market Research & Commentary

Certainty will return to the financial markets

In the midst of this chaos, we’re all searching for certainty. Whether it be certainty on when the spread will slow down, when the financial markets recover, or when normal life can resume. As we look outward, and inward, two ideas can help ease the financial market turbulence by exposing the market’s reaction for what it is: a normal part of investing. Aided by previous stock market performance, certainty will begin to emerge. These two ideas are: 1.) the Black Swan; life is more random than we think and therefore more prone to extreme events than we predict and, 2.) the Planning Fallacy; we’re bad at planning and projecting events into the future. Simple as that, these two ideas will have major implications for how we react to the market and prepares for what’s next.

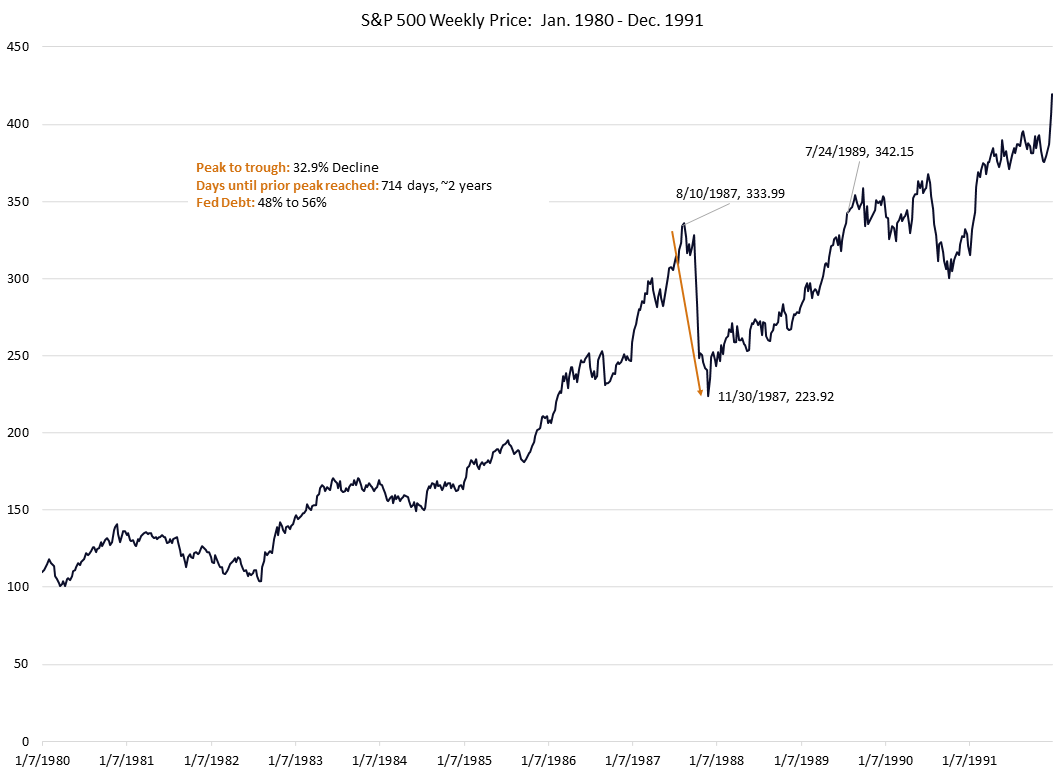

We’ll start with stock market data to scope out the applicability of the Black Swan and the Planning Fallacy to the current challenge the world is facing and the market’s reaction.

A common thread in all of these these periods is an element of a Black Swan event or a planning fallacy mindset, which is what we will now turn to.

A “Black Swan” event was popularized by the book the “Black Swan” by Nassim Taleb. In his book, Taleb colorfully and practically depicts the challenges of predicting, managing and living life in an uncertain world e.g. extreme events happen with surprising frequency.

Given that life is so uncertain we trick ourselves into certainties through the use of standard statistical models (concepts) and mental shortcuts or heuristics to get by. Taleb argues these tactics are woefully insufficient, and dangerous for anticipating circumstances like what we find ourselves in today. As a result, we are prone to severe negative consequences (e.g. the 2008 – 09 financial crisis, 1987 Black Monday, 9/11). To overcome these shortfalls, we need to expand our realm of possibilities and accept that the likelihood of extreme events is more far common than we expect in non-physics-based settings (e.g. basically all activities involving human input/interaction).

Next, to the Planning Fallacy. As discussed in his seminal book “Thinking, Fast and Slow” Daniel Kahneman describes the planning fallacy as: plans and forecasts that are unrealistically close to best-case scenarios, and plans that could be improved dramatically by analyzing the statistics of similar cases.

Initially a foreign problem, the Coronavirus has wreaked havoc on the U.S. and global economy in a way few would entertain when the virus first became an issue in January. The initial prognosis for the U.S. was concern. But, regardless of media spin or political bent, many were unwilling to initially accept or plan for the reality that the U.S. and Europe were on a dangerous trajectory.

We continued to plan and operate as if the best-case scenario would play itself out, and understandably so, national shutdowns are painful! The financial markets (a proxy for the economy, major geo-political events, and the like) finally caught up to this reality leading to the painful cycle we find ourselves in: negative economic news beset by negative news on the Coronavirus, causing more economic uncertainty and so on, as many financial crises play out. In these moments the uncertainty is palpable and, in many ways, unending. True, the pain financial ruin can create is real but certainty and a way through can still be found.

Our planning, our mindsets, have to shift towards a more random and uncertain future. What’s certain in life is that it will continue to be uncertain, likely more uncertain than the past because it contains a whole universe of unknown unknowns. It sounds so obvious when written but it’s hard to live out in practice. We’re predisposed by nature to find patterns and regularity in our daily lives.

In the S&P 500 declines outlined, the reaction is obvious in hindsight causing us to go on preparing for a similar event in the future. This isn’t reaction isn’t wrong but it misses a greater point of better preparing for that next unknown. This perspective is crucial as the U.S. and Europe have continued to use massive fiscal and monetary stimulus to get us through tough times. How many more times can these measures pile on top of the debt from the last one? What happens when the next Black Swan is even greater? Sound financial decisions, planning for more extreme events than we can anticipate from the past is needed in times like these.

The United States, the world, has faced just as great, possibly greater challenges in the 20th Century. Down to the individual, we showed our resolve and fought through difficult times, this is no different. 2020 will continue to be prone to extreme events, and we’ll need to continue to rethink our planning and predicting for what’s in store. These are uncertain times, but keeping the extreme events of the past in perspective, normalcy in life, in the financial markets, will return in its own certain way.